Weston Hospicecare was born in 1989 when members of the Weston-super-Mare community realised the need to care for those who were very ill at the end of their life.

In 1991, the first day services began which was followed in 1997 by the opening of an inpatient unit. In 2002, we moved to Jackson-Barstow House in Uphill. A change which was made possible thanks to an incredible charitable gift from Enid Sybil Jackson-Barstow.

Her incredible contribution provided a springboard towards the present day where we care for more than 1,000 patients and their families every year. Gifts in wills are still a vital part of providing care, read more about how crucial they are by clicking here.

Read more on Weston Hospicecare’s services by clicking here.

Over 30 years of care...

Where it began...

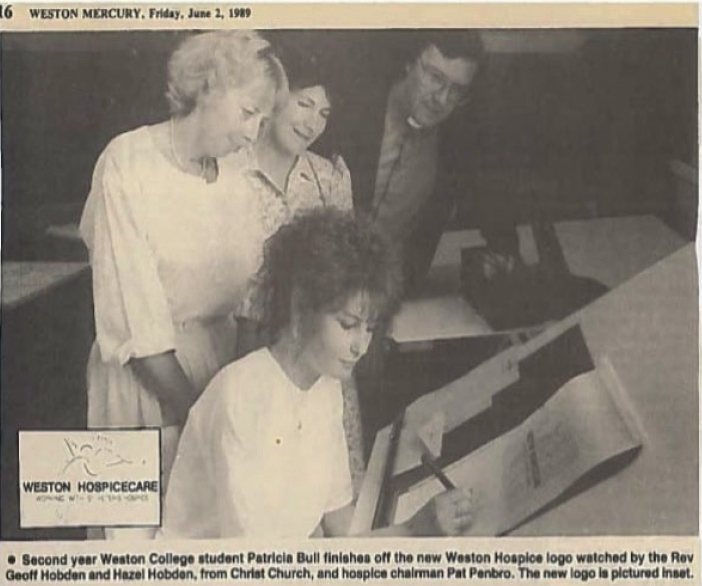

Weston Hospicecare was founded by a small group of people associated with Christ Church in Montpelier. They had a vision, that “There must be something better for those who are in need of end of life care”.

Community support fuels launch

After 18 months of planning, the support from local doctors and donations from individuals and community groups, the charity was officially launch and an office was opened at 7 The Boulevard, Weston-super-Mare.

First shop starts trading

A shop in Baker Street was offered to the hospice. Volunteers cleaned, painted and stocked the shelves. £70 was raised in the first day and ‘Weston Hospicecare Mart’ was in business.

Shop income, coupled with non-stop fundraising efforts led to the appointment of two Clinical Nurse Specialist who visited people in their homes to offer care, advice and pain relief.

Volunteers received bereavement training and met the first hospice Grief Counsellor for adults and children.

A group of volunteers were trained to provide non-stop nursing support to patients and their carers.

Two key hospice legacies set sail

Day hospice care began and the very first Mendip Challenge took place. Today, it is the hospice’s biggest participation and fundraising event.

Hospice buy first permanent home

Weston Hospicecare purchase Branton House after an abundance of public donations. Several rooms were used to care for Day Hospice patients.

Hundreds of home visits conducted by hospice

Community Nurses make 753 visits to patients in their own homes. Meanwhile, the inaugural Christmas remembrance event takes place and the Friends of the Hospice ramp up fundraising activity.

First high profile patron appointed

Jill Dando was welcomed as a patron and headed up ‘The Mercury Millennium Appeal’ for a new inpatient unit. The hospice now employed seven nurses and day hospice provided care for four days a week.

First inpatient unit created

The hospice received a sizeable level of funding from the lottery for a new inpatient unit. The charity received £303,000 which was invested in producing the facility at Branton House.

It also covered the cost of 11 nurses, a bank of 20 cover nurses, two unit assistants and a clinical assistant to provide extra cover.

Bulging capacity leads to expansion

140 patients had already been cared for in the IPU. The need for more beds was urgent so the conservatory was adapted to take an additional bed.

Hospice benefits from first guardian's gift

The very first Hospice Guardian, Enid Sybil Jackson-Barstow, left a gift in her will to the hospice.

Jackson-Barstow House in Uphill was purchased. This remains the home of Weston Hospicecare today.

Jackson-Barstow House officially opens!

Jackson-Barstow House officially opened with 10 inpatient unit rooms, Day Hospice and catering facilities.

Community benefits from hospice impact

Five community nurses made 3,027 visits to care for 558 patients in the community.

Day Hospice now had three members in its team and with volunteer support cared for patients during 2,058 attendances.

Ladies raise £100,000 for Weston Hospicecare at night walk

The first Moonlight Beach Walk, known as the Midnight Beach Walk, raises £100,000 for Weston Hospicecare.

Therapeutic garden and 24/7 phone line launch

A grant funded the development of therapeutic gardens on hospice premises. These gardens have been enjoyed by patients and their families ever since.

A 24-hour advice line opened to patients and families needing expert advice.

New services launched for families

Companion and Buddy Groups were formed to offer informal bereavement support.

The year of big steps forward...

The hospice celebrated its 25th anniversary with the opening of the Wellbeing Centre. This essential service vastly improving quality of life for patients through a variety of physical and emotional health therapies. 420 treatments given in the first year.

Regular multi-disciplinary meetings commenced with Weston General Hospital, End of Life Team to ensure a ‘joined up’ approach to care for every patient.

The number of patients and families needing support continued to rise with 811 community patients and over 9,000 face-to-face visits.

Hospice supporters continued to raise much needed funds and gifts in wills ensured end of life care needs were met.

Emotional and spiritual support services join forces

Bereavement, chaplain and companion services joined forces to better meet the emotional and spiritual needs of patients and their families. A team of volunteer counsellors were trained and the new Family Support Team made 2,811 contacts.

Medical students received training at the hospice Wellbeing Centre to learn about communication and therapies to relieve stress and anxiety of patients.

Men in sheds begin and trainee GPs start Weston Hospicecare partnership

The hospice starts to regularly welcome trainee GPs to share palliative care expertise.

The need to support men who had lost loved ones was met by the launch of ‘Men in Sheds’. The group enjoy weekly meet ups, finding friendship and camaraderie whilst working on various projects such as gardening and woodwork.

The big three-zero and young people bereavement services begin

2019 marks the 30th anniversary of Weston Hospicecare. It also saw children and young begin receiving emotional support from the hospice.

How the hospice performed through COVID

COVID-19 Brough unprecedented challenges to hospice care services. Front-line hospice key workers showed phenomenal dedication, strength and compassion in their efforts to keep vital patient and bereavement services going despite restrictions.